The cryptocurrency industry has emerged as a financial and technological revolution in the last decade.

However, as in many technological sectors, female participation has historically been limited, we see that the majority of participants and interested parties are men.

In the context of International Women’s Day, it is crucial to reflect on the presence of women in the crypto industry, we will study the progress and trends they have been taking in recent years to recognize the challenges they face and highlight initiatives that seek to promote greater inclusion and leadership within the crypto and financial sector.

Globally, women represent approximately 15% of total cryptocurrency users. This figure reflects a significant underrepresentation compared to their male counterparts.

Although these data may vary between different regions, a similar trend is projected, for example in Latin America, it is estimated that 25% of the cryptocurrency community is made up of women, which indicates a slight improvement in female inclusion in this region (later we will analyze initiatives in this region by women).

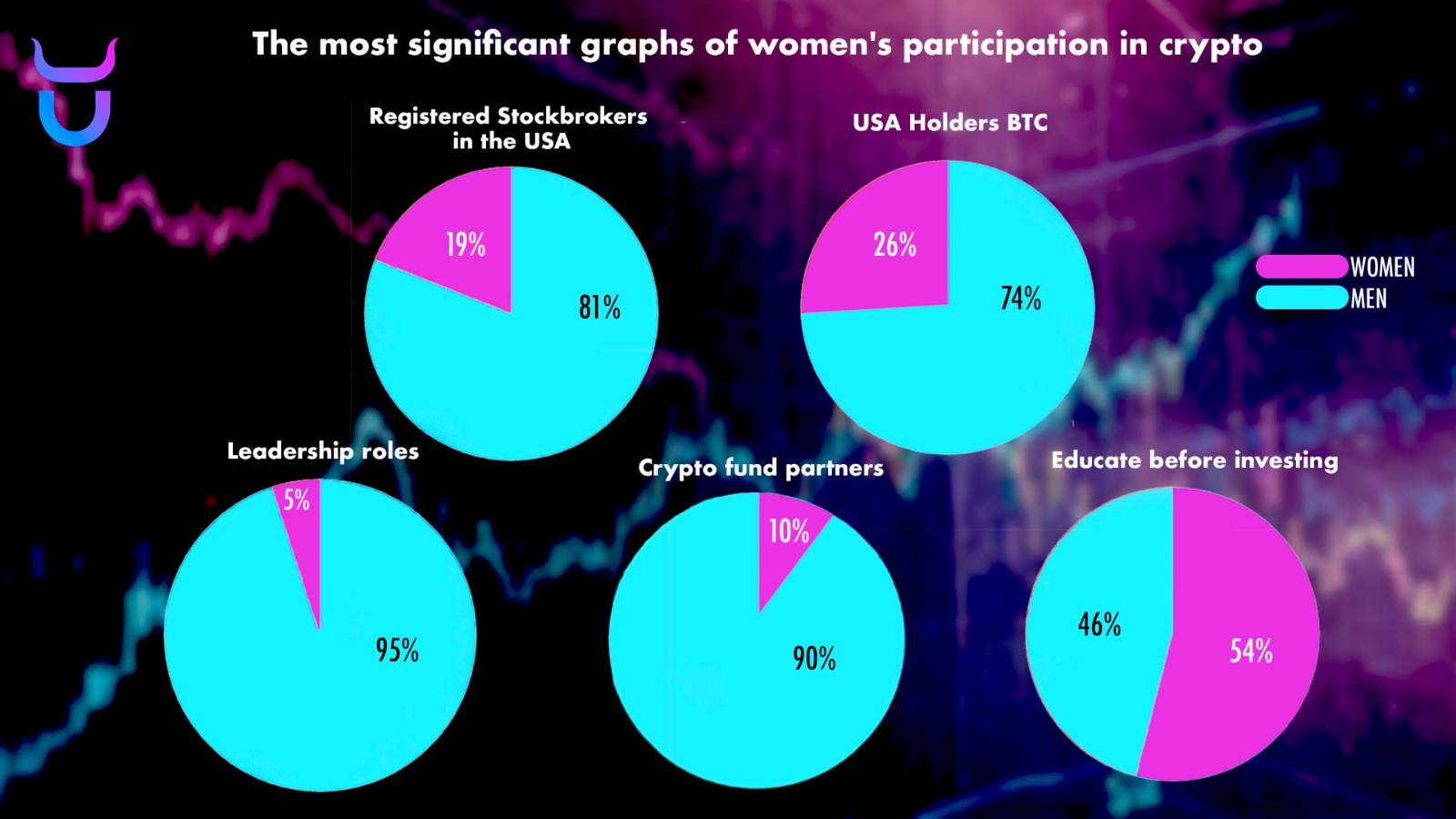

The presence of women in technical and leadership roles within the crypto industry is even smaller. Less than 5% of cryptocurrency founders and less than 10% of cryptocurrency fund partners are women. Of the top 50 cryptocurrency CEOs in 2023, only three were women. These data show a significant gender gap in key roles within the industry. Although the participation of women in high ranks increases every year, it is key to encourage and comply with a minimum space occupied by women within the productive organization of companies.

More and more women are becoming interested in the sector, and the gap in interest is narrowing compared to men, with 46% of women expressing a potential interest in digital assets, a figure not far behind the 54% of men. This suggests that while men are currently more likely to invest, women‘s curiosity and openness to learning about cryptocurrencies is on the rise and will likely see more balance in the coming years with regulations and greater adoption.

Ali Daylami, Head of Data Analytics at BITmarkets Academy, noted that while men tend to be more proactive in the cryptocurrency space, women are more inclined to seek education before making any investments. And here is one of the key points to achieve greater inclusion:

The investor, worker and academic profile is different for women. According to the survey, 54% of women prefer to take a course or participate in professional education before investing in cryptocurrencies, compared to 50% of men.

From a more speculative perspective, we see that in developed countries like the United States, only 26% of current cryptocurrency holders are women. Although this figure is low, it represents an opportunity to increase female participation in trading activities and active use of cryptocurrencies.

The participation of women in the financial sector, especially in areas such as trading and investment fund management, has historically been limited. Let’s look at some data to reflect on.

For example, among female stockbrokers in the United States in 2021, women accounted for 19% of all registered stockbrokers in the United States.

Although online investors, according to a 2021 report by Acorns Grow, say that women made up only 38% of online investors, while men accounted for 62%.

Leadership in Listed Companies: A 2025 Equileap report highlighted that only 7% of listed companies worldwide had a woman as CEO, and 9% had a woman as chair of the board of directors. According to a Preqin study, women represent approximately 19.3% of employees in the hedge fund industry, which shows a slight increase from 18.6% recorded in 2017.

However, at higher levels, female representation is lower: women make up only 11% of senior staff, compared to 29% in junior roles.

As we see in senior positions, a very marked bias towards female leadership remains, but in lower-ranking positions the increase in women as workers is more significant, which allows us to think in the future that these women in lower ranks, after several years of careers within companies, may access presidencies and boards to a greater extent, improving the data in the near future.

As a curious fact, in terms of investment performance: A 2019 study by Fidelity (a multinational financial services corporation) revealed that, on average, women obtained 0.4% more returns on their investments compared to men.

The private equity sector has long struggled with gender diversity in leadership. While 78% of fund managers report having female talent in leadership positions, only 31% have a woman as CEO, and a third of private equity firms still lack female representation on their management committees.

In contrast, NuDEX stands as one of the few crypto trading platforms led by a woman, demonstrating that innovation and leadership in blockchain are not bound by traditional norms. Caria Wei, co-founder of Nuvosphere (parent company) and the driving force behind NuDEX, is redefining decentralized finance by bridging the gap between Web2 and Web3 while ensuring users maintain full control over their digital assets.

With over a decade of experience in software and hardware product management, Caria has been at the forefront of blockchain innovation. Before leading NuDEX, she was Head of Product and DevOps at Metis, where she played a role in advancing Ethereum Layer-2 scaling solutions. Her vision extends beyond technology—she is a passionate advocate for diversity and inclusion, championing an equitable digital landscape where innovation is fueled by diverse perspectives.

Under her leadership, NuDEX is not just a decentralized exchange; it’s a movement toward financial empowerment. By integrating cutting-edge security, privacy, and usability, NuDEX is making DeFi more accessible to everyone—regardless of background or experience. Through her work, Caria is proving that strong leadership in blockchain can drive both technological advancements and meaningful social change.